Reintroducing bveCVX: Managed Convex, the Right Way

BadgerDAO

Jun 24, 2022

With over $4b of weekly trading volume, the Curve (CRV) AMM is a backbone of DeFi and especially important in the stableswap space since the design allows very low slippage trades between assets assumed to trade at like value.

Convex Finance (CVX) is a metagovernance layer on top of Curve and has become the single biggest player in controlling where CRV token emissions flow. CRV incentives attract liquidity to various pools in Curve, which help stabilize the prices of some of the largest assets in DeFi. Convex has become so valuable that a secondary market, Votium, has sprung up for protocols to “bribe” CVX holders, in effect purchasing the liquidity driven by their votes.

BadgerDAO’s bveCVX product is the next layer of this stack. It simplifies the lives of CVX holders, making it easy to enjoy the economic benefits of holding the “DeFi kingmaker” token, without having to participate in governance votes and frequently collect and sell bribe tokens.

Since it was launched eight months ago, bveCVX has undergone several iterations before reaching its current state. This article presents the key benefits of this product in a Q&A format. If anything is unclear, please pop into the Badger discord and ask away.

Who is bveCVX for?

Getting yield from CVX is a lot of responsibility (aka: work). You have to remember to lock it every 16 weeks, you have to vote in governance every 2 weeks, and collect bribe tokens and decide what to do with them (hodl, sell, lock, etc). Even for very large holders, it can amount to a part time job to manage and optimize the position.

bveCVX is for people who are interested in capturing the economic value of holding CVX but without having to perform regular transactions, some of which require ETH gas expense.

What does bveCVX Do?

bveCVX is a “set and forget” managed CVX layer. All you have to do is deposit your CVX and Badger does the rest:

- Locks your CVX and auto re-locks it following a one-week withdrawal window after each unlock. You do not have to take any action if you want to keep earning.

- Votes for an optimal yield on Votium. This is done by a bot operated by BadgerDAO which allocates votes to optimize bribes. Running our own voter allows us to redirect some of the vote to support other liquidity and to blacklist tokens that do not have sufficient liquidity on Ethereum and can not be easily bridged by our bribes processor (for example Luna, Geist, and other tokens that have primary liquidity on another chain).

- Collects & Sells Bribes Bribes earned by bveCVX are sent to the BribesProcessor. The bribes processor contract uses Cowswap to sell tokens and emit to bveCVX holders, and is restricted from other operations or maliciously transfering funds. The bribes processor has a feature that allows anyone to release all bribes unprocessed to bveCVX holders should the processor be abandoned by the multisig for more than ten days.

- Autocompounds Rewards into more bveCVX. It also issues rewards in the form of BADGER and bcvxCRV, which itself autocompounds in a Badger helper vault.

- Supports Its Own Liquidity A portion of the fees bveCVX charges go to incentivize a Curve pool that allows some early exit liquidity for users who want to withdraw before the 16 week unlock period.

- Get Boosted Rewards on Badger Vaults: As an added sweetener, your bveCVX position also counts as 50% of native value in the Badger Boost system, meaning that participating in bveCVX earns you more BADGER rewards on your Boost-eligible deposits with Badger. More details on this here.

How does voting work?

Every two weeks, protocols post bribes on Votium to attract CVX votes for CRV emissions to pools on Curve Finance. These incentives attract liquidity to their token pools and in turn support their token.

At each round, Badger’s bveCVX autovoter bot reviews the bribes on offer, selects the voting option that yields the highest ROI in bveCVX terms, and then votes accordingly. This is all done programmatically and does not require any multisig operations. When bribes become available, the system automatically sells them using Cowswap to minimize frontrunning. These rewards are then paid to depositors in a ratio of 75% bveCVX and 25% BADGER.

What are the fees and their purpose?

-

Deposit Fee: none

-

Withdrawal Fee: .1% of assets (this is a minimal fee needed for security reasons)

-

Vote Influence Fees: The vault takes fees in the form of vote influence, some of which support the health of bveCVX itself. These fees are allocated as follows:

- 5% Vote Weight for Liquidity Support: sold for bribes and paid as BADGER to bveCVX/CVX LPs. This supports the overall liquidity of bveCVX and allows some users the option of early exit from the lock.

- 5% Support for WBTC / BADGER Liquidity: supports BADGER token liquidity on Curve, which is a key part of the rewards mix.5%DAO Fee: this fee supports the DAOs operations, including developer time, code audits, gas fees, and overhead.

- 5%DAO Fee: this fee supports the DAOs operations, including developer time, code audits, gas fees, and overhead.

Liquidity?

CVX locked in the Convex governance contract (vlCVX) cannot be sold before it unlocks (16 weeks from lock).

bveCVX offers users a limited amount of exit liquidity through an incentivized Curve pool. As of June 22, the pool held 61,000 CVX and 73,000 bveCVX (45/55%). This pool is not large enough to allow all bveCVX users to withdraw early, but provides a meaningful amount of exit liquidity, which is currently the deepest available among the managed Convex solutions on the market. Significantly more liquidity is available on the 16 week rolling unlock cycle, and you can always see how much CVX is currently withdrawable from the vault detail page.

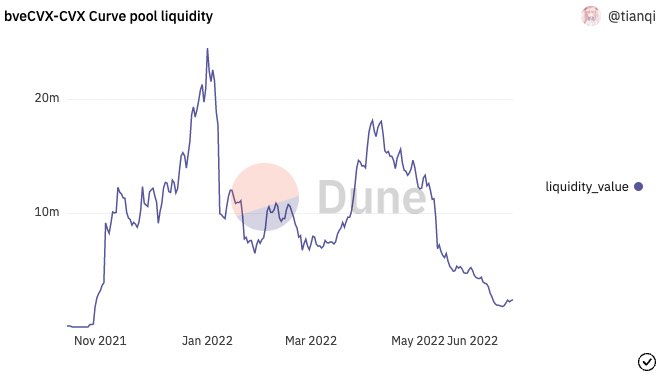

The following graph shows the historical Curve liquidity depth of the bveCVX/CVX pool.

Source: https://dune.com/tianqi/cvx-yield

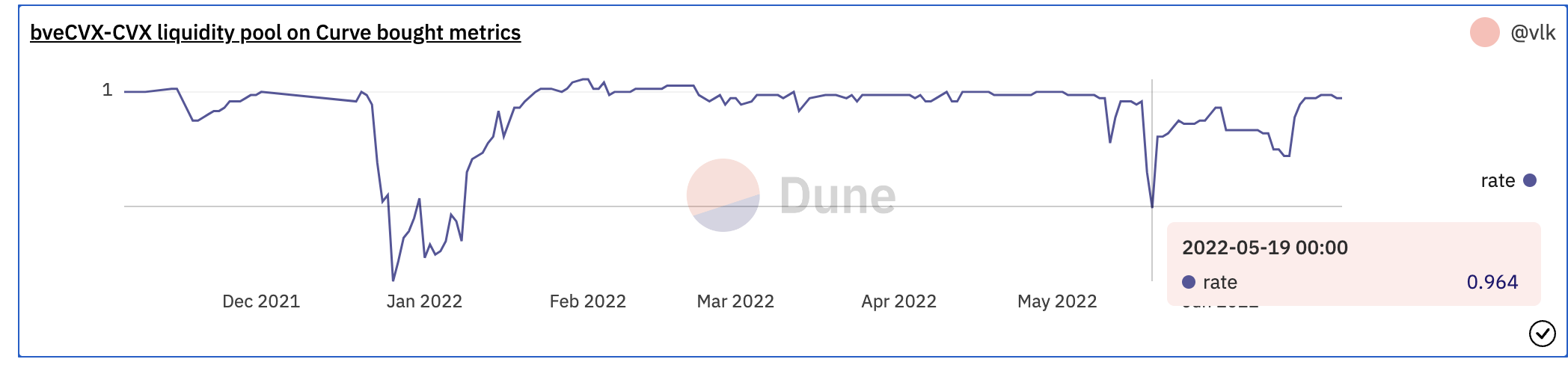

And here is a plot showing performance of the bveCVX to CVX peg performance:

Source: https://dune.com/queries/956356

Security

bveCVX has been operational as a core Badger product since September 2021. It was audited in 2021 by C4, the full audit results and mitigation steps are available here.