Badger Vaults Evolved: APY's Explained

BadgerDAO

Oct 11, 2022

Understanding APY’s can be a full time job. Is the math ever really correct? Are those insanely high numbers really telling the truth? The answer is more complicated than you might think. Providing the most accurate rate of return in real time is a real challenge but it's not for lack of trying. There are a ton of variables that play a role in how the math is calculated and displayed in the UI. Fret not, all hope is not lost.

Badger has done extensive work to ensure the most accurate, real time information is being displayed within the app while providing an additional layer of data for interested users to verify the numbers for themselves. This article takes deeper look at the ingredients in the APY soup, Badger's approach to APY display, and how Badger is leveraging deep tech to maximize efficiency and mitigate impending issues.

Ingredients in the APY Soup

APY stands for Annual Percentage Yield and the main objective of this number within the app is to display the most accurate yearly rate of return on a user's deposits. But how? This number takes into account factors such as the amount of deposits in the vault at a given time, the price of reward tokens and emissions schedule.

Although issues related to pricing and liquidity can affect how the number is displayed, real time, accurate APY’s are not a fallacy. Although these external factors do encourage users to be cautious in their pursuit of high yields and to consider additional factors before aping into something new. These factors can cause significant change to the displayed number in a short period of time and while APY’s are a helpful tool, ensuring your funds are in the most risk adjusted position with a reasonably sustainable yield % should be top priority.

AP-Why So Complicated?

Now that we know the ingredients, let's talk about the recipe. It takes a skilled chef to assemble everything into a dish worth eating. In the case of APY’s, there are different ways to collect, process and cook up the data. Currently Badger uses both historical and projected methods to display returns in the app.

Historical APY

When calculating the Historical APY, Badger compares the timeframe in which rewards are earned with the total value of funds in the vault in order to calculate the yield per event. Events over a two week period are averaged out to produce the Historic APY % you see in the Badger app. Unfortunately this only allows for a weighted look back at past performance thus only giving an idea of what MIGHT happen vs. what is currently happening with yields.

This method is only used on older Badger vault tech including the two influence vaults; bveCVX and graviAURA. These particular vaults rely on bribe collection which cannot be calculated until a given voting round has completed thus rendering this impossible to incorporate in real time.

Current APY - The Preferred Method

When calculating the Current APY, Badger is able to simulate an actual harvest using the current claimable rewards and the time they were last harvested to produce the most accurate current yield for users. In the case of Yield Bearing Rewards, Badger uses the current APY of those assets actualized over a year to determine the compounding interest that would be attributed to the overall APY based on the rate at which they are being earned.

This method is preferred based on its ability to report the most accurate data in real time despite the maturity of the vault. The example below shows the life span of the newly launched rETH/WETH Aura Vault. In this case, the historic APY has been under reporting the APY since launch as it requires about a 2 week period to ramp up.

The ability to measure Current APY through simulated harvests based on current data in real time results in a more accurate number right out of the gate.

Badger Ninja

Wanna verify the math yourself? With Ninja Analytics, you can! Badger has been actively developing a platform to curate vault data in a way that enables interested users to understand the products more deeply. You may have noticed this linked as Ninja Analytics on the vault display page in the app. This new tool gives users the ability to track vault behavior and performance in real time and better understand vault operations and the rewards they are receiving.

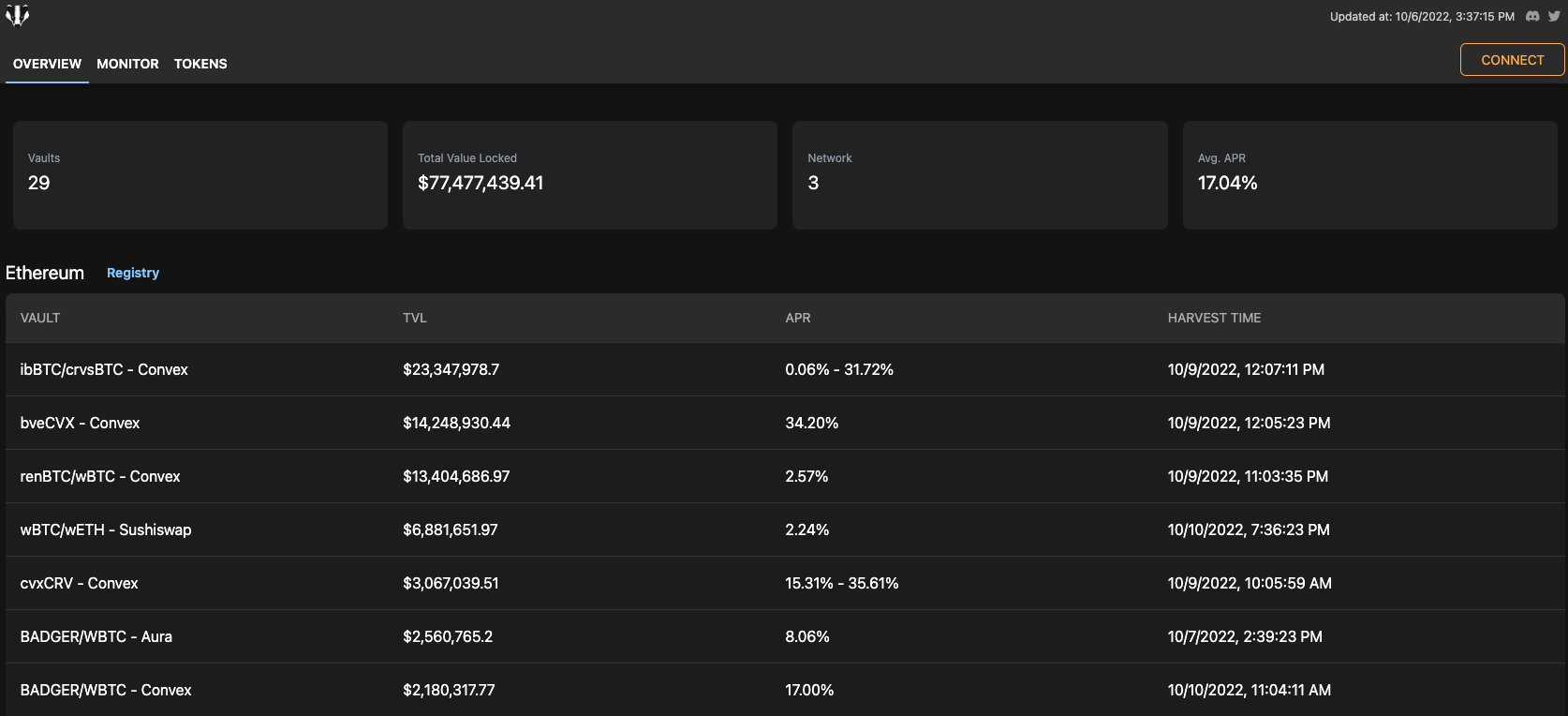

You can analyze a vault’s full history of performance since inception to see how APR has changed over time as well as view AUM in USD or token denominations. Additionally, Badger Ninja includes a monitor view of vaults on all chains that support live monitoring to ensure they are always working as expected.

Monitoring Performance

The Badger monitoring system was built to track the health of vault harvests in order to ensure they are performing in line with expectations. It measures the vault's current yield against the harvested yield. For example, if a vault is reporting 10% yield earned, but the harvest is reporting 3% yield earned, the monitoring system flags this as an issue, allowing further investigation and preventing users from getting rekt.

Badger uses this monitoring in house to alert our engineering teams of any issues as it allows for a swift assessment of the situation in order to determine a solution that ensures suboptimal earning is rectified.

Ape Safely and Smartly

While displayed APY’s can be a useful tool for identifying new earning opportunities, they are not the only thing one should consider when making a decision. New tokens with low liquidity can produce significant swings during the early days of farming causing extremely high APY’s to drop significantly as new deposits enter and rewards are sold off.

When considering whether to ape into the next 4000% APY opportunity, users should first consider the safety of the contracts, overall security approach and track record of the protocol and perhaps temper their expectations. While it's not impossible to farm at such a high rate of return, this typically won’t last very long and may not be worth the risk in the long run.